The effects of the mortgage crisis continue to make the U.S.’s Latino community very anxious. Both homeowners and renters are still being affected by the depressed housing market, unemployment and a slow economy, according to results of the most recent impreMedia/Latino Decisions poll.

The national poll revealed that even the most prosperous and integrated segment of the Latino population, citizen voters (who were the focus of the poll), are still afraid of losing their homes if they are unable to pay. This situation has changed what the so-called American Dream means to them.

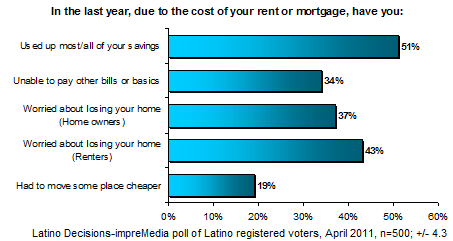

As an example, 43% of renters and 37% of homeowners worry about losing their homes during the next year. Those who have not lost their homes have been affected by the crisis in other ways: 51% have used up all their savings to make their monthly mortgage payments, while 34% had to stop paying other bills to make their payments. [ Full Poll Results Here ]

“For us, the most obvious result of this poll is that the mortgage crisis has seriously affected the Latino population, eating into family savings and generating anxiety that affects both homeowners and renters,” said Gabriel Sánchez, a political science professor at the University of New Mexico and an adviser for the poll.

A typical example of this anguish is being experienced by the Mojica family in Deltona, Florida. Jacqueline Mojica, one of the poll’s participants, explained that her family is having a hard time, since her husband is an independent truck driver and she is on disability. “The gas continues going up and if my husband loses his job, we lose everything,” said Mojica during an interview after the poll.

For almost a year, during which they saw their income plummet, the Mojicas were unable to pay the mortgage of the house they bought six years ago. “We were behind in everything, especially the credit cards. My husband had problems with the truck and was not earning… we were spending up to the last penny,” she said.

The family is uninsured and it would be extremely expensive for them to buy individual insurance, a sign that the health care reform has not yet benefited them. She has Medicaid and her children have Healthy Kids (Florida’s Healthy Families insurance).

Not long ago, they were able to obtain a mortgage modification from the bank, and they are in a three-month trial period. “The payment stays the same, but at least we have not lost the house,” she said.

The mortgage crisis is also affecting what the American Dream means to the U.S.’s Latinos. Although people are still optimistic, opinions are divided on the role being a homeowner plays in being successful.

Those polled were asked directly whether they thought they had reached the American Dream or if they could achieve it. Slightly more than a third, 36%, said they were living it, while another 36% said they would reach it in their lifetimes. Only 18% felt defeated, expecting that they would never achieve the American Dream.

“We see that despite the problems, there is still optimism about overcoming the crisis and reaching personal success,” said Matt Barreto, a professor at the University of Washington and director of the poll.

That lasting optimism is what makes Rita Hernández Macías, of Palmdale, California, 31, believe that she can still achieve success some day. All that despite the hard times she has lived through in recent months.

“I had to move in with my parents three weeks ago and leave the apartment I had,” said Hernández. “I lost my job in sales. People are still not spending.”

On that issue, Latino voters do not seem very different than the overall population of the United States. A recent National Journal poll found that 59% of adults in the United States feel they are living the American Dream, while 75% think that it is still within reach. However, the difference between Latinos and the population in general can be seen in how Latinos perceive the American Dream. While the National Journal poll showed that 80% of respondents think homeownership is one of the main conditions to reach that success goal in this country, Latinos are divided on this: 47% believes the dream means buying a home, while 40% thinks the dream can be achieved without purchasing a home.

“Buying a house is no longer such a big part of living a secure life in this country, at least not when there is so much volatility in that area, particularly for Latinos,” said Sánchez.

Latinos are affected the most and favor more help

The impreMedia/Latino Decisions poll showed solid support from Latino voters for government solutions for the problems of families and the housing market. There is also little trust that banks or lending institutions will help.

“There is no trust in the banks, and they have been blamed for much of what has happened,” said Barreto.

Among the solutions and policies Latinos support, according to the poll, are more tax incentives for buyers (83%), helping people who have lost their jobs with their mortgage payments (75%), requiring banks to provide documents in English and Spanish if the customer needs it (87%) and reducing monthly mortgage payments for homeowners who cannot afford the entire payment (79%).

However, there is not much trust that decision-makers in Washington are listening to the Latino community. Only 10% thinks politicians take into account the needs of Latinos, while 41% said that they take them into account “somewhat” and 40% said that they do not take them into account.

During the years the housing market was expanding, minority buyers quickly increased their homeownership rate, partly because they were given more opportunities to obtain sub-prime loans.

In fact, according to Raúl Hinojosa Ojeda, a professor of urban planning at UCLA, Latinos and blacks were two to nine times more likely to have high-cost mortgages than the white population.

The proof is in the pudding: A judge in Los Angeles found last week that Wells Fargo Bank discriminated against customers in minority areas of the county, charging them millions of dollars more for their mortgages than for mortgages issued to customers in white-majority areas.

Because of this and their higher unemployment rate, the mortgage crisis has hit Latinos and other minorities harder. Experts agree on this. It may also be the reason why Latinos are the ones most in favor of government intervention to help homeowners who are in trouble.

A study about the effects of the housing crisis on Latinos by the National Council of La Raza revealed last year that this crisis will drain $177 billion from Latino homes while it lasts. Housing is a central issue for Latinos, since two-thirds of their personal wealth is in the appreciation in the value of the homes they own.

It was also estimated that approximately 1 million Latinos have lost or will lose their homes before the crisis ends

METHODOLOGY: Latino Decisions surveyed 500 registered voters between March 24th and April 2nd in 21 states with the largest Hispanic populations, comprising 94% percent of the US Hispanic electorate. Voters were selected randomly from the registered voter lists and households were identified for contact using the Census Bureau Hispanic surname list, and merged with third party data to secure telephone numbers. A mix of landline and cell phone only households were contacted for the study, and results were weighted to census universe estimates to account for minor deviations from known population characteristics. The margin of error is ± 4.38% on the full sample.

Voter registration status and Hispanic identification were verified upon contact with respondents, who confirmed if they are registered to vote and of Hispanic/Latino descent. Census Bureau reports suggest approximately 90% of all Latinos in the U.S. have a Spanish-surname. In identifying citizens registered to vote, the registered voter list is far superior to either a simple RDD or household list of Spanish-surname households because of non-citizenship, low rates of voter registration among Latinos, and well-documented propensity of all survey respondents, regardless of ethnicity, to over-report registration status.

Surveying was conducted by fully bilingual interviewers. Respondents were greeted in both languages, and surveys were conducted in either English or Spanish, at the discretion of the respondent. Up to five callbacks are scheduled for each record. The survey instrument was created by Dr. Matt Barreto, Dr. Gary Segura and Dr. Gabriel Sanchez in consultation with impreMedia and translated into Spanish. The survey was administered under the direction of Pacific Market Research, in Renton, Washington, and performed using a Computer-Assisted-Telephone-Interviewing (CATI) protocols. CATI programming is performed by Pacific Market Research. Average interview length was 12.13 minutes.